Table A. Comparative Statistics for Financial and Insurance Activities Section:

MIMAROPA Region, 2021 and 2020

Financial activities group had the most number of establishments in the financial and insurance section

The Annual Survey of Philippine Business and Industry (ASPBI) final results showed that a total of 1,037 establishments in the formal sector of the economy were engaged in financial and insurance activities (FIA) in 2021. This represents an increase of 15.2 percent from the 900 establishments recorded in 2020. (Table A)

Among industry groups, other financial service activities, except insurance and pension funding activities posted the highest number of 783 establishments (75.5%). This was followed by monetary intermediation with 205 establishments (19.8%) and insurance with 41 establishments (4.0%). (Figure 1)

Figure 1. Distribution of Establishments under Financial and Insurance Activities Section

by Industry Group: MIMAROPA Region, 2021

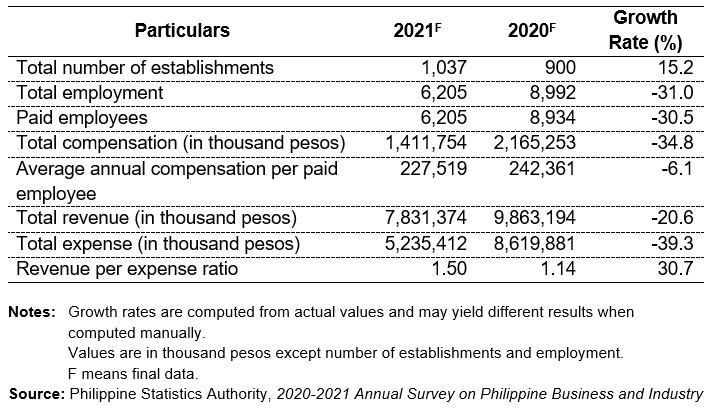

Total employment in financial and insurance activities section decreased by almost one-third

The total employment in the FIA section of the MIMAROPA Region was recorded at 6,205 workers as of 15 November 2021. This indicates a decrease of 31.0 percent from the 8,992 workers reported on the same date in 2020. Of the total workforce for the FIA section, all the 6,205 employees were paid employees. (Table A)

Figure 2. Employment for Financial and Insurance Section

by Industry Group: MIMAROPA Region, 2021

The FIA section recorded an average of six (6) workers per establishment in 2021. This represents a 40.0 percent decline from the reported 10 workers per establishment in the previous year. (Table A)

Among industry groups, monetary intermediation had the highest average employment of thirteen (13) workers per establishment. Moreover, this was the only industry group under financial and insurance section in the region that surpassed the regional employment per establishment ratio of six (6) workers per establishment.

Meanwhile, insurance and other financial service activities, except insurance and pension funding activities followed with an average employment of seven (7) workers and five (5) workers per establishment, respectively.

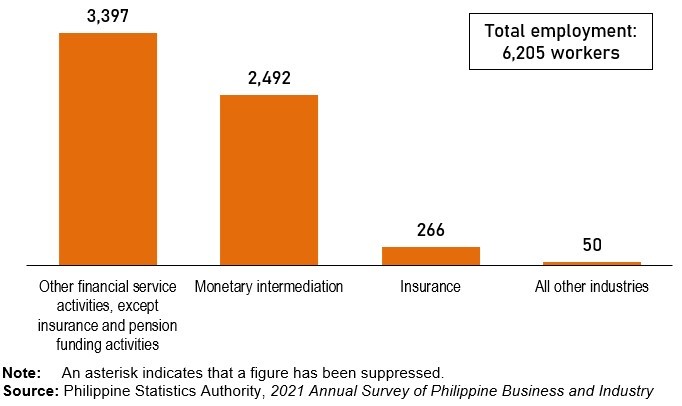

Insurance industry group paid the highest average annual compensation per paid employee

In 2021, the total compensation paid by the section to its employees amounted to PhP 1,412 million. This translates to an average annual compensation of PhP 227,519 per paid employee, which indicates a 6.1 percent decrease from the recorded average annual pay of PhP 242,361 per paid employee in 2020. (Table A)

Figure 3. Average Annual Compensation per Paid Employee from Industry Groups

in the Financial and Insurance Activities Section: MIMAROPA Region 2021

(Average Annual Compensation in Thousand Philippine Pesos)

By industry group, employees from insurance establishments received the highest average annual compensation of PhP 583,372 per paid employee in 2021. This was followed by monetary intermediation and other financial service activities, except insurance and pension funding activities industry groups with average annual compensation per paid employee of PhP 287,000 and PhP 153,717, respectively. (Figure 3)

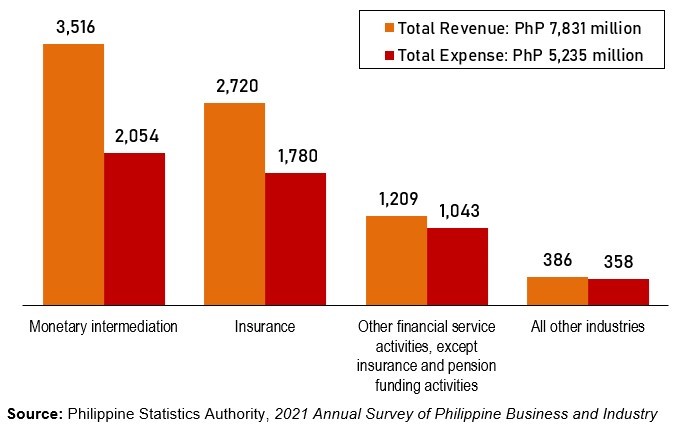

Monetary intermediation group contributed the major share to the total revenue and total expense

The total revenue generated by the FIA section in 2021 reached PhP 7,831 million, indicating a decrease of 20.6 percent from the PhP 9,863 million reported revenue in 2020. On the other hand, the total expense incurred by the section amounted to PhP 5,235 million in 2021, which shows a 39.3 percent decline from the PhP 8,620 million total expense posted in 2020. (Table A)

Figure 4. Total Revenue and Total Expense for Financial and Insurance Activities Section

by Industry Group: MIMAROPA Region 2021

(Total Revenue and Total Expense in Million Philippine Pesos)

Among industry groups, monetary intermediation contributed the highest share to FIA’s total revenue amounting to PhP 3,516 million (44.9%) in 2021. Insurance followed with a corresponding total revenue of PhP 2,720 million (34.7%) and other financial service activities, except insurance and pension funding activities PhP 1,209 million (15.4%). (Figure 4)

In terms of expenses, the top spender was monetary intermediation group with PhP 2,053 million. This translates to a 39.2 percent share to the FIA’s total expenses. Insurance and other financial service activities, except insurance and pension funding activities came next with incurred total expenses of PhP 1,780 million (34.0%) and PhP 1,043 million (19.9%), respectively. (Figure 4)

Revenue per peso expense ratio of monetary intermediation and insurance surpassed the regional level ratio

In 2021, the revenue per peso expense ratio of the financial and insurance activities section was recorded at 1.50, which reflects an increase of 30.7 percent from the recorded 1.14 revenue per expense ratio in 2020. This indicates that for every peso spent in 2021, the section generated a corresponding revenue of PhP 1.50. (Table A and Table 2)

By industry group, monetary intermediation registered the highest revenue per peso expense ratio of 1.71. Insurance came second with a recorded revenue per peso expense ratio of 1.53. The other financial service activities, except insurance and pension funding industry group posted a revenue per expense ratio of 1.16, lower than the regional level ratio. (Table 2)

(SGD) LENI R. RIOFLORIDO

Regional Director

MLLM / OHG / RRL / MTYAD